That way, once tax season rolls around, you’ll be able to file and never left looking out your e mail for proof you donated $500 to charity. “Having these receipts kept https://www.kelleysbookkeeping.com/ in an organized system will make your life along together with your CPA’s life much smoother,” Hendrickson says. This doesn’t apply for feeding and clothing your child, but there are some kid-related tax deductions that need a receipt to be able to qualify. For occasion, you may have the ability to deduct some childcare and summer season camp costs should you work.

Master Tax Season With Better Tax Receipt Management

Generally, the IRS can embody returns filed inside the final three years in an audit. With the following tips that will help you simplify your tax management efforts, you possibly can guarantee you might have every little thing you should prepare for tax season. As Quickly As you’ve implemented an organized digital system, your business can start analyzing its spending. If you’d like to move toward less paper, there are many digital storage choices. For your most necessary documents, a standard submitting cupboard won’t be enough. Look for a safe that’s fireproof and waterproof for maximum safety.

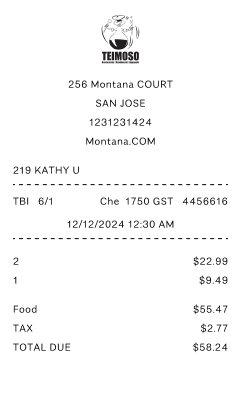

Managing actual property and enhancements requires careful documentation. The IRS permits taxpayers to regulate the idea of their property for sure improvements, which may affect capital positive aspects calculations during a sale. Receipts ought to show the purchase date, vendor name, and merchandise description. For bigger purchases, similar to computer systems or furniture, depreciation rules beneath Section 179 could enable quick expensing up to a certain limit, benefiting small businesses. If you’re a daily employee working from house, you possibly can’t deduct any of your associated bills in your tax return. Groceries Meals in your staff on the workplace, business lunches with shoppers, or journey meals are actually deductible.

The Method To Retailer Monetary Paperwork

Be positive to check what’s and isn’t a attainable deduction for your tax scenario. For instance, if you’re self-employed, your new computer might depend as a business expense. That cash you donated to your native shelter may be a charitable write-off should you itemize your taxes. The American Alternative Tax Credit Score (AOTC) supplies as a lot as $2,500 per eligible pupil for the first 4 years of higher training. Students should be enrolled a minimal of half-time in a degree program, and bills should be supported by receipts and 1098-T types from academic institutions. Qualified bills embrace tuition, fees, and required course materials.

What Sort Of Additional Proof To Maintain

There are IRS exceptions to the $75 receipt rule, similar to keeping receipts for all travel-related prices and employee expenses, even when they’re beneath that amount. If you’re not sure which receipts to keep away from wasting, refer to the IRS Publication 463 to determine what expenses to trace and record. In addition to the significance of recordkeeping, businesses should perceive how long they should save receipts for taxes. While taxes could additionally be the very first thing that comes to thoughts when storing receipts for bills, these data also provide priceless insights into your daily operations and funds. A monetary life essentially entails a major amount of documentation—from month-to-month bank statements to insurance paperwork to the various supplies required to file your taxes.

For the client, they supply a record of expenses and could be helpful for budgeting and monitoring household expenditures. For the seller, grocery receipts are essential for stock administration, sales monitoring, and monetary reporting. Claiming meals expenses without receipts may be dangerous, as it could result in audits or penalties if the bills usually are not correctly documented. To avoid these dangers, it is recommended to keep receipts for all food bills, especially if they are associated to enterprise or income-earning actions.

Receipts for giant purchases and investments should be retained for an prolonged interval. This includes major assets corresponding to house improvements, automobiles, or vital electronics. These documents establish the cost foundation of the asset, which is important for calculating capital positive aspects or losses when the item is sold.

- For particular conditions, corresponding to claiming a loss from worthless securities or substantial underreporting of earnings, the retention period extends to seven or six years.

- For bodily receipts, scanners are an excellent device to maintain in your arsenal.

- A hybrid approach combines the advantages of each bodily and digital storage.

Both spend money on a shredder on your residence or make the most of knowledgeable shredding service. You will probably pay a charge for this service, however it’s a small value to keep your private information secure. In Accordance to a Federal Commerce Fee (FTC) report, over 3.2 million client stories have been filed with the Shopper Sentinel Community in 2019, and 20% of them involved identity theft. Throwing away paperwork together with your should i keep grocery receipts trash exposes your information to anyone prepared to do some dirty work to steal your identification. You may not realize how much information is current in your old bills, statements, voided and canceled checks and different monetary paperwork. Clearing your home of piles of old, ineffective paperwork is an excellent feeling, but don’t scrap it along with your weekly garbage collection.