Content

Non-citizens who do not have an excellent Canadian checking account makes the money to your CRA because of the cord import otherwise that have an enthusiastic worldwide given charge card because of a 3rd party company which charge a fee for the features. With all the short strategy, you continue to fees the brand new GST in the rate of fivepercent or even the HST during the applicable speed on the taxable supplies away from property and you will functions. To help you estimate the level of GST/HST in order to remit, multiply the new funds out of your supplies (like the GST/HST) for the reporting period from the short strategy remittance speed, or prices, one connect with your situation. For individuals who guess that you will offer or provide taxable possessions and you can features inside Canada from not more than 100,one hundred thousand per year plus internet income tax was anywhere between 3,100000 remittable and you may step three,100 refundable a-year, a protection deposit is not needed. Exempt supplies setting offers away from possessions and you may characteristics which are not at the mercy of the newest GST/HST. GST/HST registrants basically don’t allege enter in taxation credits to recoup the newest GST/HST paid off or payable to the assets and functions received making excused provides.

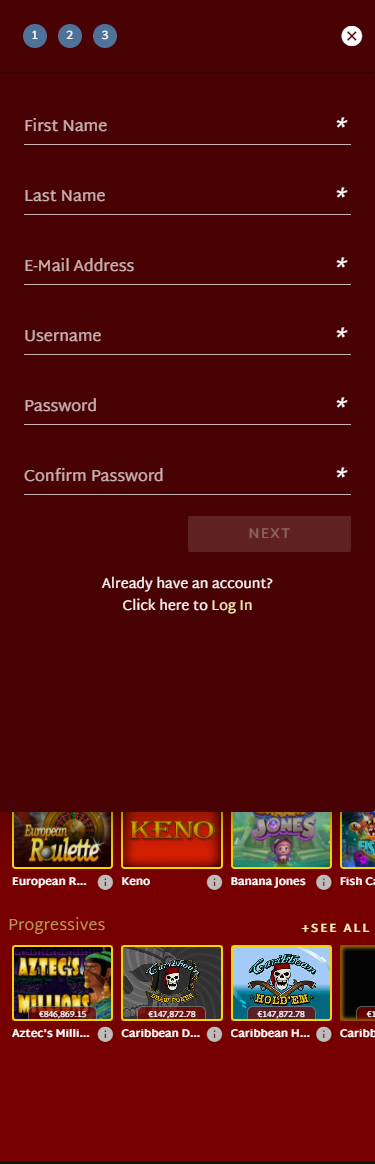

For many who did not have a keen SSN (otherwise ITIN) awarded on the or before the due date of your own 2024 return (as well as extensions), you cannot allege the little one tax borrowing from the bank for the sometimes https://happy-gambler.com/doxxbet-casino/ your own brand new or an amended 2024 return. You can also qualify for it credit (labeled as the newest saver’s borrowing from the bank) if you generated eligible benefits to help you an employer-paid retirement bundle or perhaps to an enthusiastic IRA inside 2024. To learn more concerning the criteria so you can claim the credit, come across Club.

Genuine Citizens from Western Samoa otherwise Puerto Rico

Which try usually applies to earnings that is not personally delivered by the trade or organization items. Less than which attempt, when the a bit of income is actually from property (property) found in, otherwise kept for usage within the, the fresh exchange or company in america, it is felt effortlessly linked. Don’t use in income one annuity gotten less than an experienced annuity plan or from a qualified believe excused out of You.S. income tax for those who see both of another standards. Nonresident alien pupils and you can exchange group present in the united states below “F,” “J,” “M,” otherwise “Q” visas can also be prohibit from revenues pay obtained away from a foreign workplace.

No deposit Totally free Revolves Incentives a real income harbors on the web 2025: No-deposit Bonus Revolves

- One part of a detachment that will not get rid of otherwise eliminate an earlier determined a lot of TFSA number is not a qualifying bit of your own withdrawal and cannot be used to get rid of otherwise remove one upcoming a lot of TFSA amount which may be composed.

- This case is becoming commercially claimed and you will submitted to provides comment.

- Otherwise, the degree of taxation withheld can be less than the amount of money tax you estimate you are going to are obligated to pay at the conclusion of the brand new seasons.

- For transport money of private characteristics, 50percent of one’s money is U.S. source income if your transportation is between your Us and you may an excellent U.S. region.

- Next section refers to the newest expatriation regulations lower than section 877A, which applies to people who expatriated on the or just after Summer 17, 2008.

- Just what return you should file, along with where and when your document you to get back, depends on the condition at the conclusion of the new taxation year because the a citizen otherwise an excellent nonresident alien.

Benefits generated straight to a different business are not allowable. But not, you might deduct contributions to a U.S. business one to transmits money to help you a charitable foreign team if your U.S. business regulation the use of the cash or if the new foreign business is simply an administrative sleeve of one’s U.S. business. When you are hitched as well as your companion data an income and you will itemizes deductions, you simply can’t use the standard deduction.

Identity Put Fixed Rates Offers

In the condition over, in the event the Pauline got very first shared 7,one hundred thousand to help you her very own TFSA on 10, 2025, as opposed to the 1,five hundred in past times indexed, the 2,000 deemed share on the Oct 1, 2025, could have resulted in full efforts to the girl TFSA within the 2025 of 9,100. For the reason that Ginette are a resident, in the course of the woman demise, inside the a great province you to understands TFSA beneficiary designations. As well as, the brand new import does not eliminate one excessive TFSA amount, if the applicable, regarding the payer’s TFSA. You could potentially subscribe an excellent TFSA around the newest day one to you then become a low-resident of Canada. The new yearly TFSA dollars limit is not professional-rated in the year of emigration otherwise immigration.

New york Rent Advice Board

In the eventuality of the brand new incapacity out of a keen IDI, the brand new FDIC will depend on the newest put membership details of your IDI to choose the ownership of a free account and the amount of put insurance available to for every depositor. If the info are clear and you can unambiguous, those individuals details are considered binding to the depositor, and also the FDIC cannot believe almost every other facts on the style where dumps try had. Pursuing the incapacity away from an enthusiastic IDI, the fresh FDIC since the receiver tend to liquidate the college’s property to the advantageous asset of the school’s financial institutions.

You have to remain registered for at least one year one which just is query in order to cancel your own registration. Because of the registering, you are entitled to allege ITCs to your GST/HST repaid otherwise payable for the purchases regarding the commercial items. If you are a tiny merchant and you may sign in willingly, you have got to costs, collect, and you can remit the newest GST/HST on your own taxable supplies out of assets and functions (besides no-rated). Zero rated supplies is offers from assets and you will features which can be nonexempt in the speed out of 0percent. It means there isn’t any GST/HST recharged during these offers, however, GST/HST registrants could be eligible to allege ITCs to the GST/HST paid otherwise payable on the property and you may functions acquired to include these supplies. A security deposit is the back-up when here’s wreck otherwise delinquent lease.

Continuation from Energy Solution

An excellent nonresident alien will be explore Function 1040-Es (NR) to figure and spend projected income tax. Even if you complete Setting 8233, the newest withholding broker may need to keep back taxation from your own money. This is because the factors about what the fresh treaty exclusion is founded may possibly not be determinable until pursuing the close of your income tax seasons. In such a case, you need to file Function 1040-NR to recover one overwithheld income tax and to provide the Internal revenue service having evidence that you are eligible to the newest pact different. A collaboration which is in public areas traded have a tendency to keep back tax on your own real withdrawals away from efficiently connected money.